Malaysia Community Pharmacies Report 2022

In this research, we are interested in finding out the impact of COVID-19 on community pharmacists in Malaysia. We will explore the community pharmacy industry from 3 perspectives which are:

- Community Pharmacists in Malaysia

- Community Pharmacy in Malaysia

- Independent and Chain Pharmacy in Malaysia

We used the published data by the Pharmaceutical Service Department dated 4th June 2022. Only community pharmacy premises and community pharmacists with Type A licenses issued are considered.

As a baseline for pre-covid comparison, we will be using our published research done in 2019 [2] as our baseline of comparison. In summary, there are 5271 community pharmacies and 3835 pharmacies in Malaysia as of 4th June 2022.

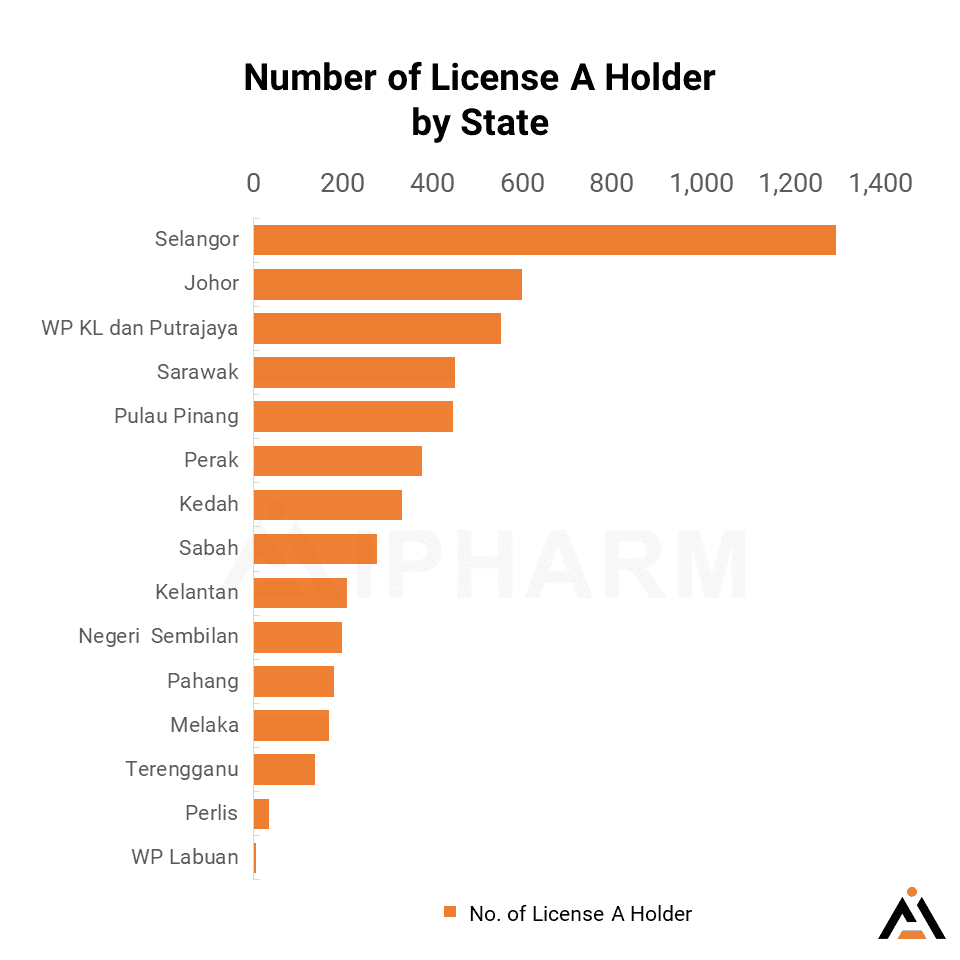

Number of License A Holder by States

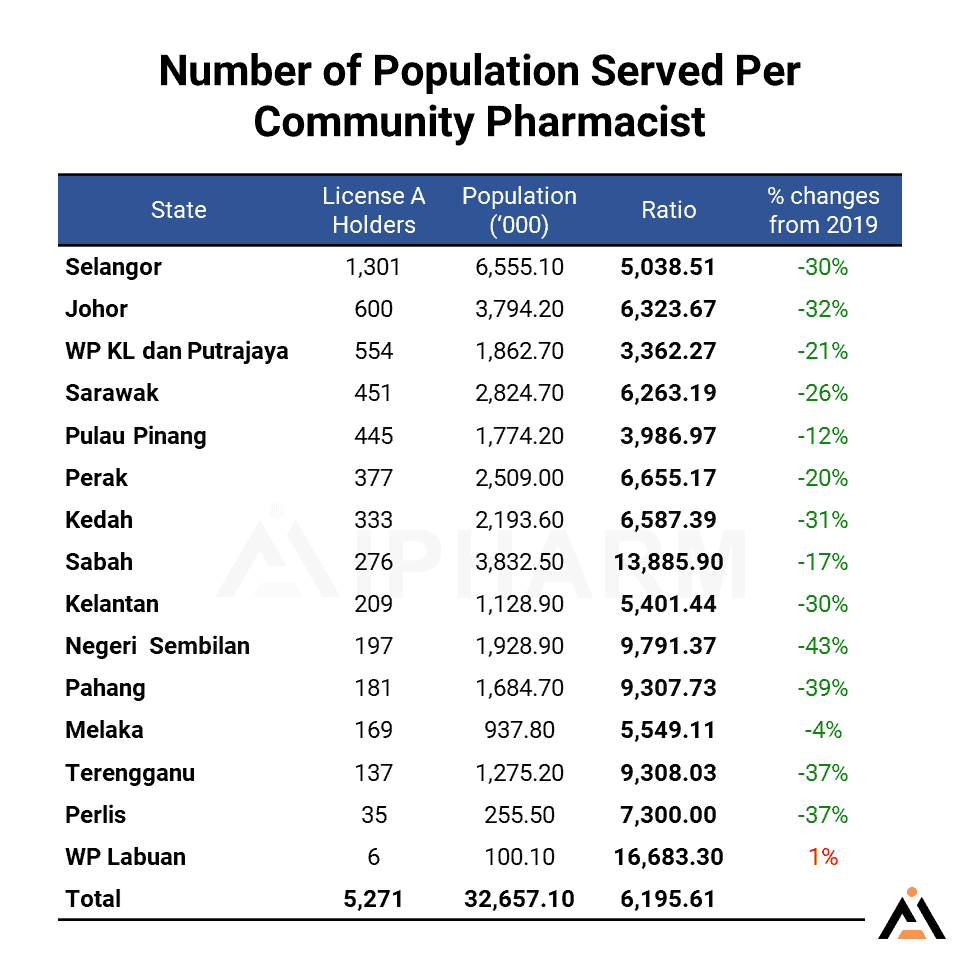

The table below shows the number of licenses A holders for each state, and the ratio of the license A holders to the population [1] is also calculated. The ratio reflects the size of the population served by each community pharmacy.

In 2022, Selangor have the highest number of license A holders, but based on the ratio, Wilayah Persekutuan Kuala Lumpur and Putrajaya have the highest density, which is 1:3,362 while Wilayah Persekutuan Labuan has the lowest density, 1:16,683. This means that in Kuala Lumpur and Putrajaya, one pharmacist has to serve about 3,362 people while in Labuan, one pharmacist has to serve approximately 16,683 people. WOW!

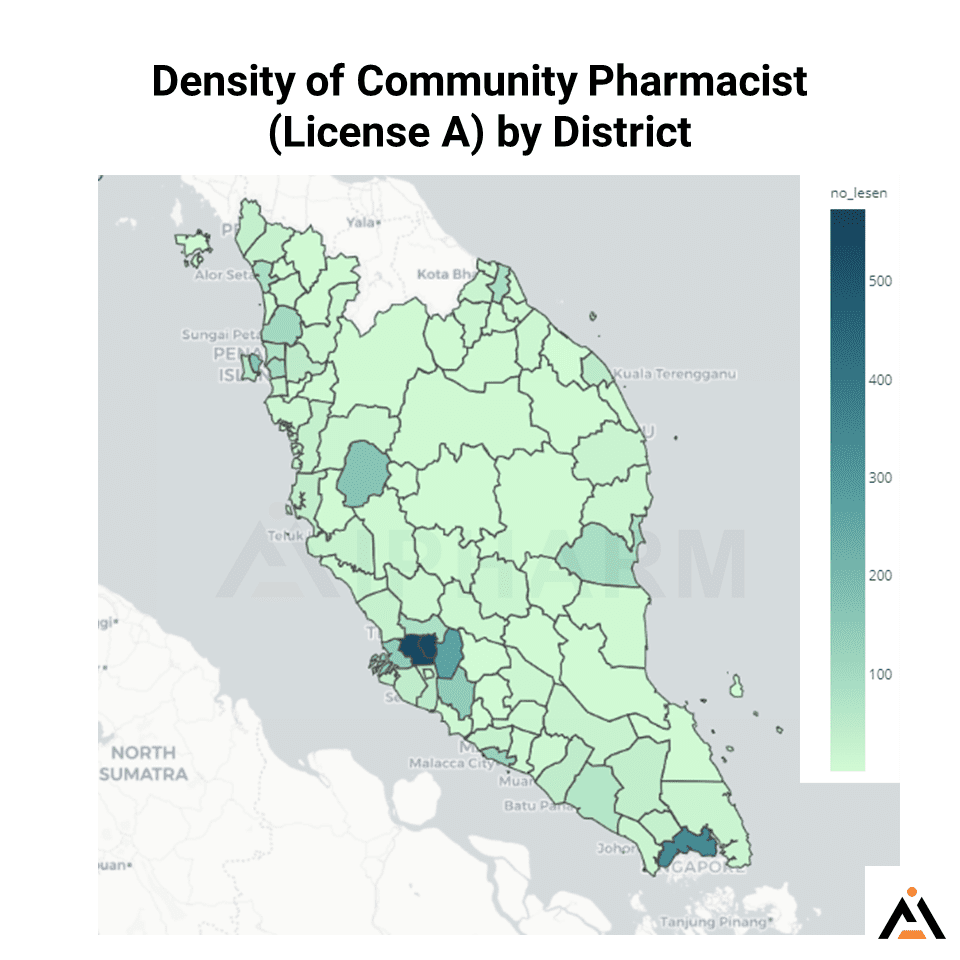

A high number of license A holders (Dark green) are focused in city areas while there are fewer community pharmacists in rural districts. The densest area is the KL district (565) and followed by Johor Baharu (344) and Hulu Langat (280). Some rural areas have as low as 3 License A holders in the district such as Jelebu (3) and Mersing (4).

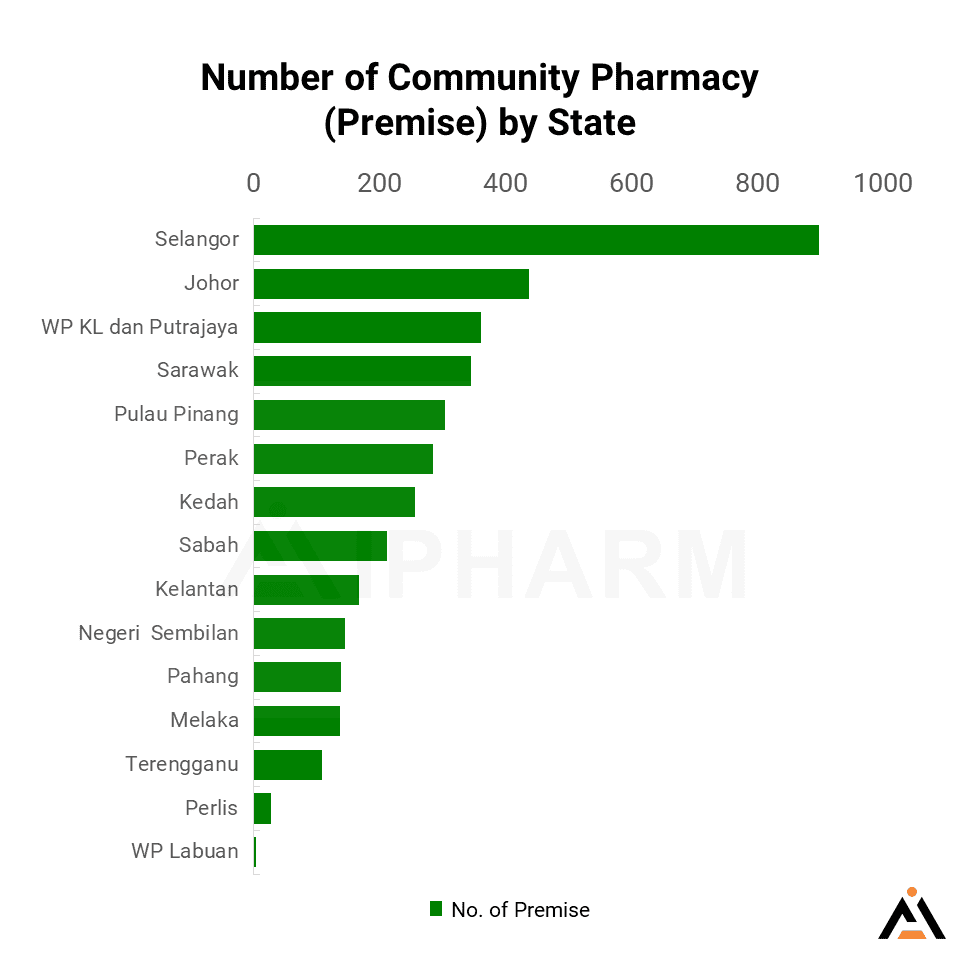

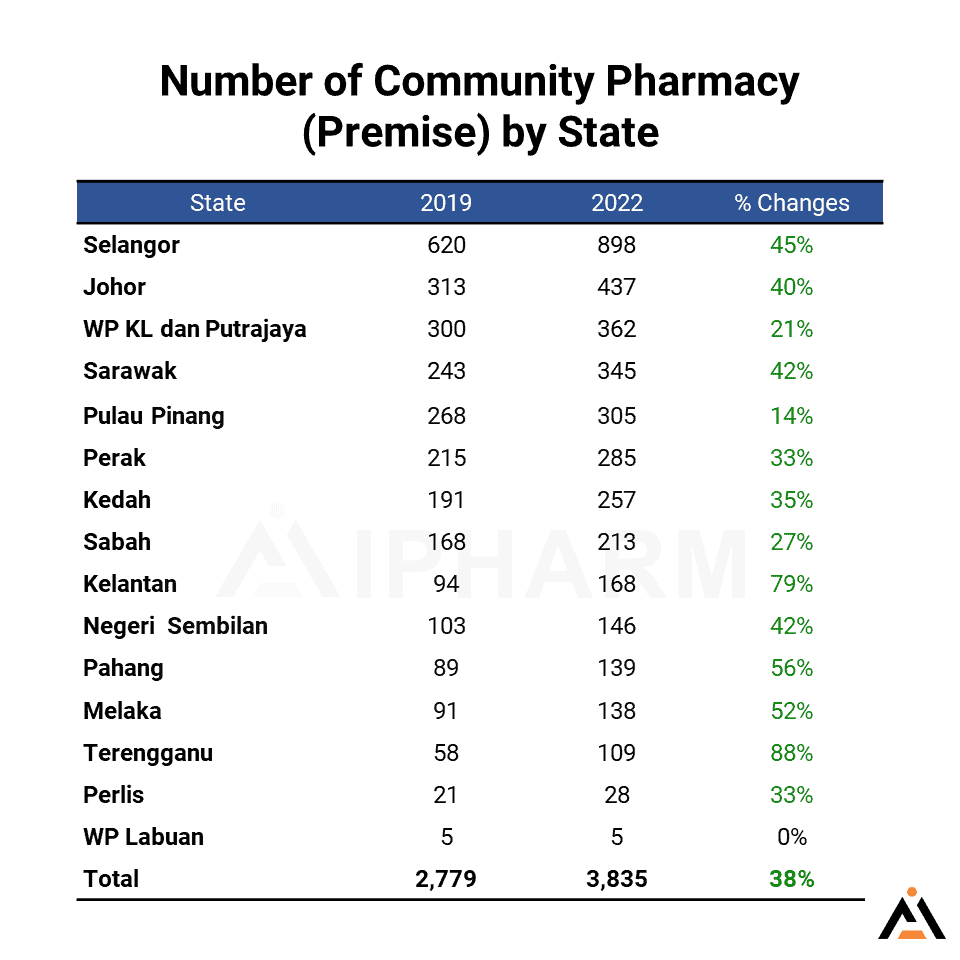

Number of Community Pharmacy by State

This covid pandemic does unleash the role of community pharmacy and draws further business into community pharmacy. The overall number of pharmacies increased 38% from 2,779 to 3,835 premises in Malaysia. Previously unsaturated states such as Terengganu and Kelantan have quickly filled with newly opening pharmacies whereas saturated states such as Pulau Pinang and WPKL experiencing a lower increment in premises.

Would this increase of pharmacies will keep on increasing in the post covid era or it is a bubble in the pharmacy industry and will lead to a burst in the next few years? In our opinion, pharmacy isn’t reaching its maximum potential. There are many roles that can be played by community pharmacists, especially in the patient care and patient wellness domain.

What is the Average Pharmacist hired by a Community pharmacy?

Instead of hiring more pharmacists to increase the quality of service, most pharmacies in Malaysia choose to expand their premises. In the year 2019, a pharmacy will hire 1.39 pharmacists on averagely. This figure decrease to 1.37 in 2022.

The average pharmacist hired for each community pharmacy has been reduced by 0.02, the changes are not huge but it indicated that the increase in pharmacists hired did not follow the increase in the new pharmacy and hence the service quality is not increased.

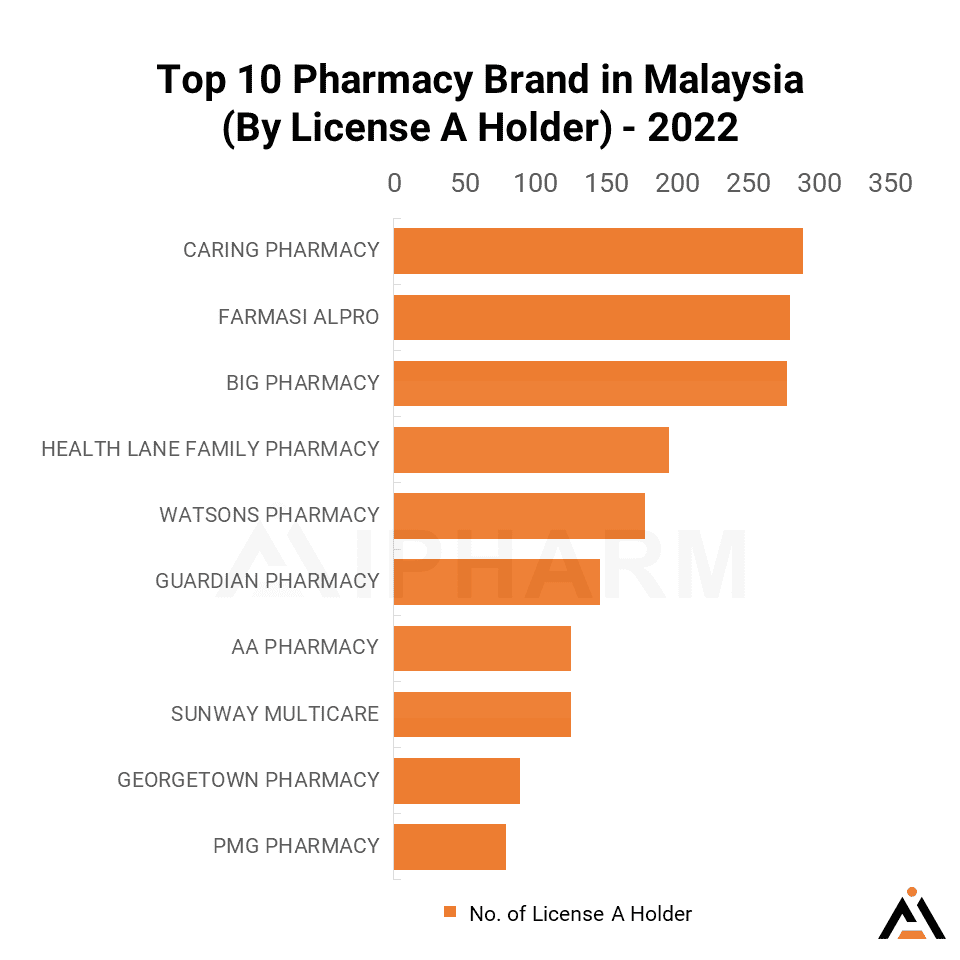

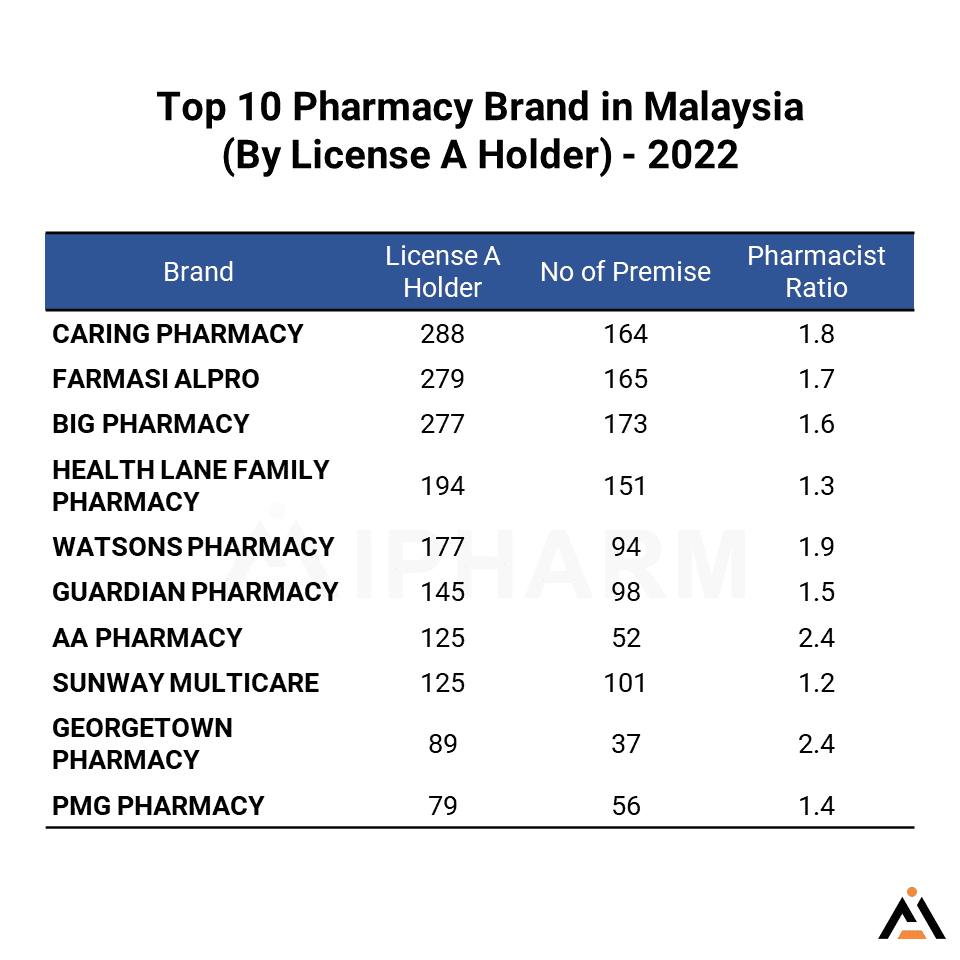

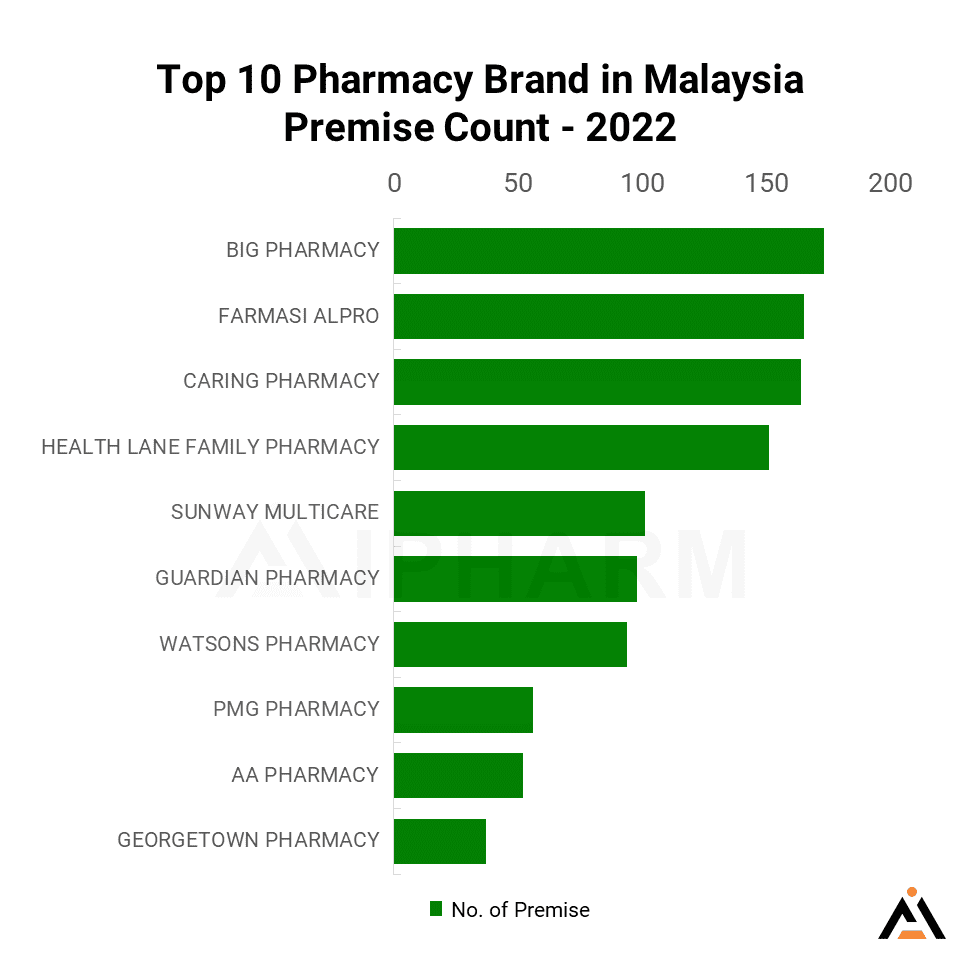

Who is the top pharmacy brand in Malaysia?

The table below shows the number of license A holders, the number of premises and the number of pharmacists per premise for the top 10 brands in the year 2022.

It is important to highlight that we sort out the ranking according to the number of License A holders registered to the brand in the year and not by premise count. It is because we think that the level of services is highly associated with the number of pharmacists but not premises.

The brand with the highest number of license A holder is Caring Pharmacy, with 288 pharmacists in the year 2022, while the Big Pharmacy has the highest number of premises, which is 173 premises. Then AA pharmacy and Georgetown pharmacy have the highest number of pharmacists per premises, which is 2.4 pharmacists per premises. Overall, the top 10 pharmacy brand takes up 34% (1,778) of community pharmacists and 28% (1,091) of the total premises in Malaysia.

In this chart we also can see the Pharmacist ratio, the mean ratio is 1.35 and there are some chain pharmacy is below the mean. It might due to their brand strategy which mainly focuses on shopping malls where only fewer pharmacists are required.

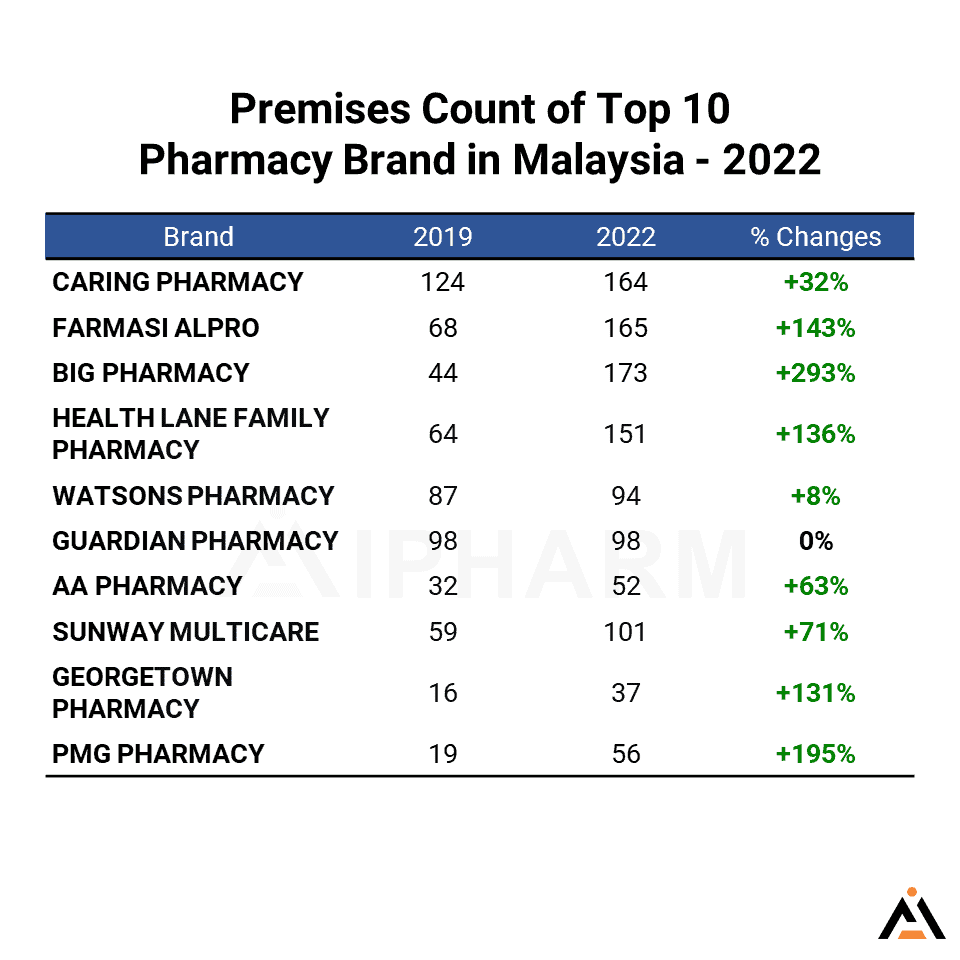

Expansion Rate of Top 10 Pharmacy Brands

Big Pharmacy is the brand with the fastest expansion, expanding close to 300% from 2019 to 2022 with an increment of almost 129 premises. Followed by PMG Pharmacy 195% and Alpro Pharmacy 143%.

From the table, we can see that Guardian Pharmacy and Watsons Pharmacy have very little growth rates. It is noticed that both brands might have pivoted their business strategy from Pharmacy to Health and Wellness stores. This can be proof that there is still a rapid expansion of the Guardian store, at the date of writing, Guardian has 523 stores nationwide and Watson has 637 stores nationwide. Most of the stores are in newly establish Malls. Will this lead to a new trend in Malaysia where more and more pharmacies pivoted to healthcare stores only?

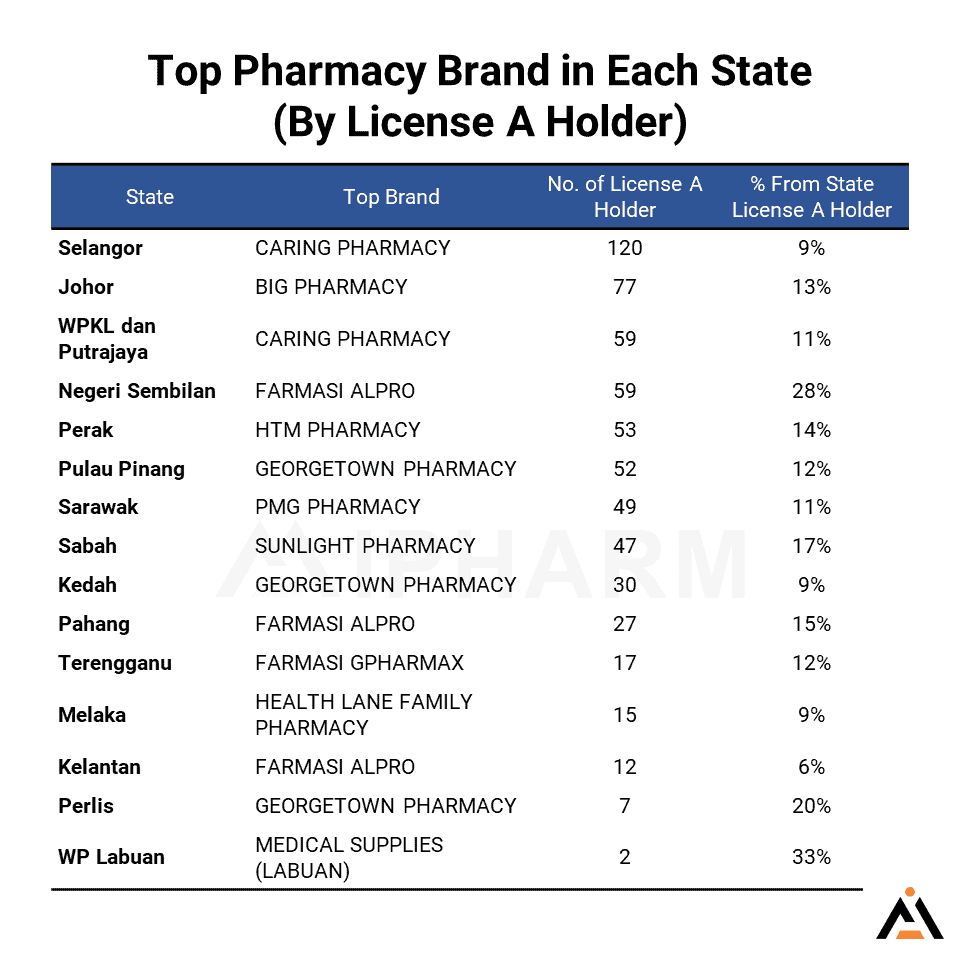

Top Pharmacy Brand in Each State

The table below shows the top brand for each State. From here we can see the distribution of the brand in Malaysia.

Caring Pharmacy is focusing on the Selangor area, which includes the Selangor, Kuala Lumpur and Putrajaya. Then, Georgetown Pharmacy is focusing on the Northern area, which includes Perlis, Kedah and Pulau Pinang. 58% or 52 pharmacists of Georgetown Pharmacy are located in Pulau Pinang.

Alpro Pharmacy has more pharmacists on the East Coast of Semenanjung Malaysia, which includes Pahang and Kelantan, Alpro Pharmacy also has the highest number of pharmacists in Negeri Sembilan, 59 pharmacists which make up 28% of the total pharmacist in Negeri Sembilan. 62% or 49 of PMG Pharmacists are located in Sarawak.

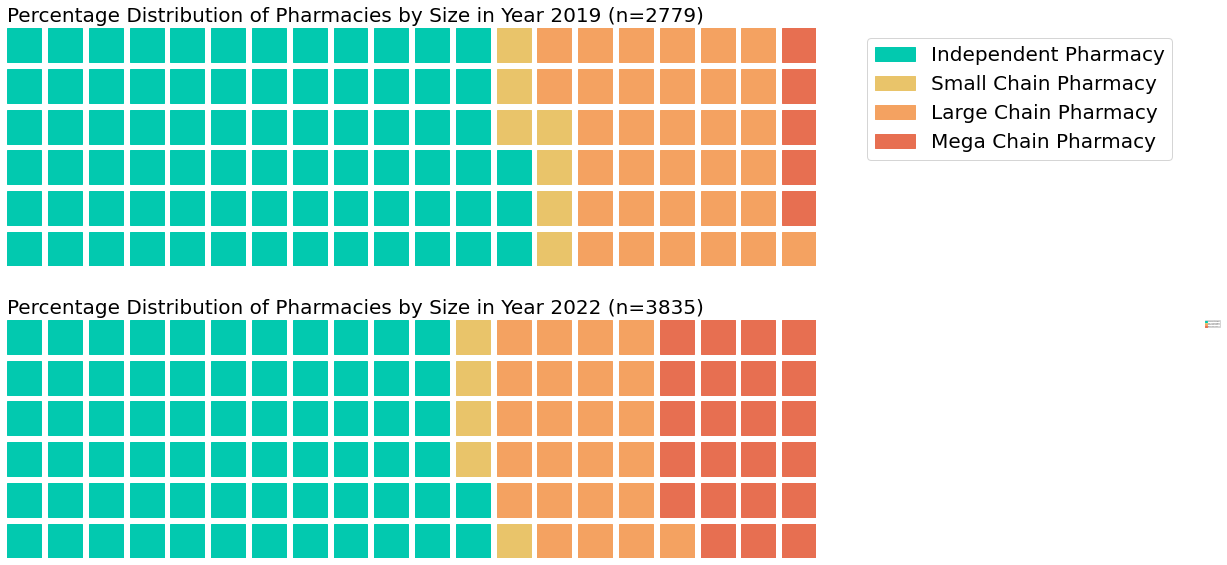

Independent Pharmacy and Chain Pharmacies

In the year 2019, 66.5% of pharmacies is independent pharmacy or small branch pharmacies. Although the total amount of pharmacies increased by 38%, the total portion of independent pharmacies and small branch pharmacies drop to 61% of the pharmacies.

It shows that the rate of chain pharmacies is expanding faster than the IP forming. Additional to that, some IPs are converted into chain pharmacies by acquisitions and mergers. It is expected that the portion of IPs will follow a decreasing trend if there aren’t any major changes in the pharmacy industry. This can be referred to as the number of IPs in the United State which contributed to 35% of all the pharmacies.

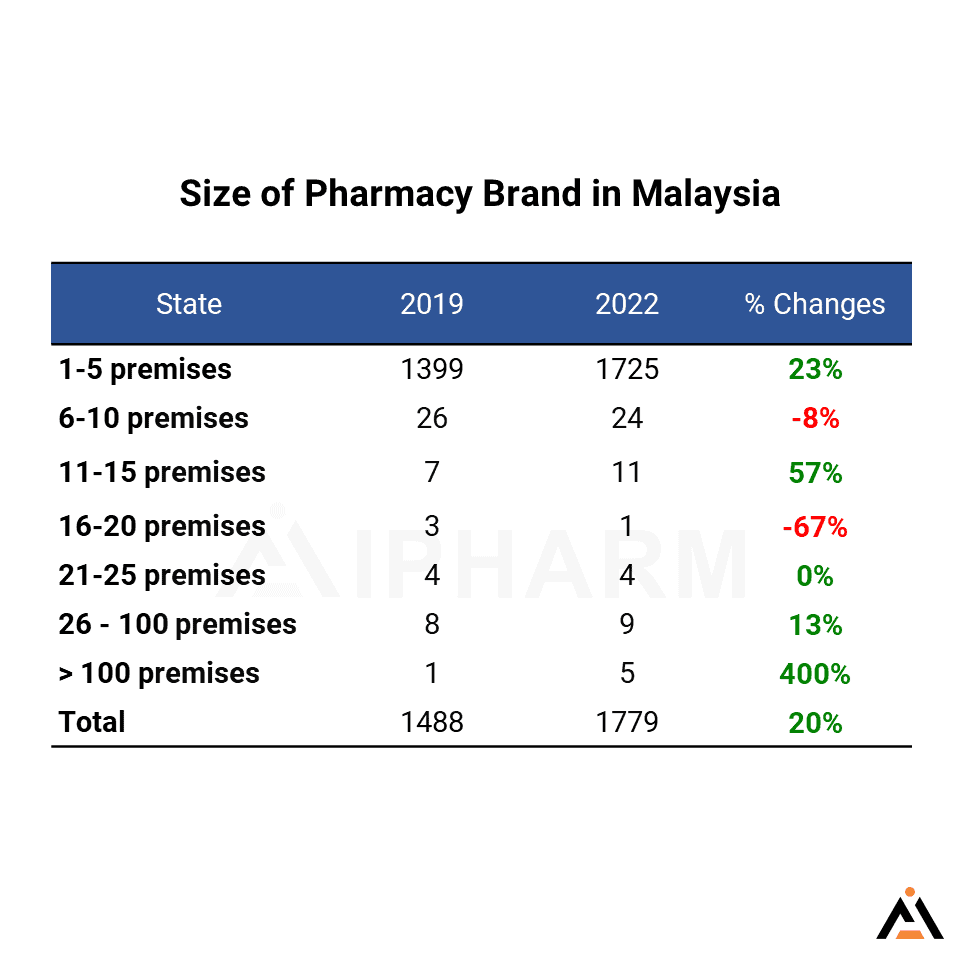

One notifiable observation in the table above is the rise of mega-chain pharmacies in Malaysia. The quick expansion of mega-chain pharmacy brands like Alpro Pharmacy, Big Pharmacy, Healthlane Pharmacy, and Sunway Multicare Pharmacy immediately make the situation of ABC-HS in the Malaysia Pharmacy Industry.

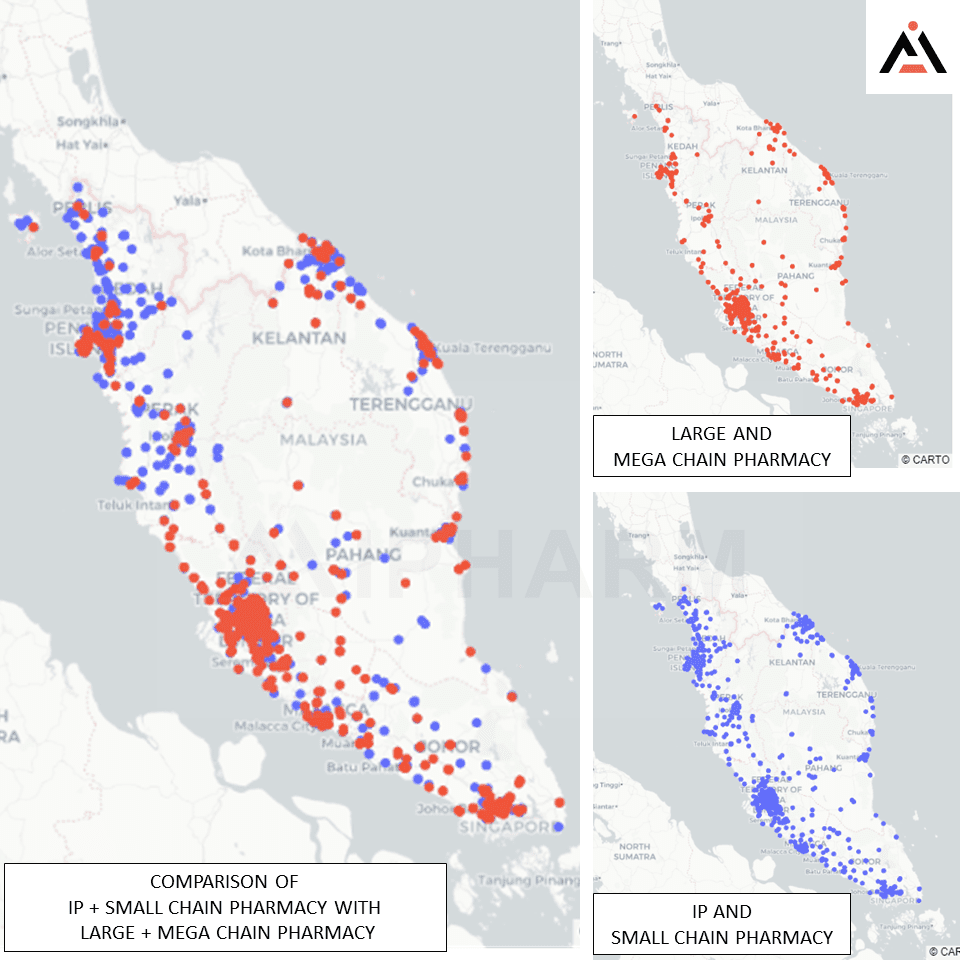

This leads us to another question since there are so many chain pharmacies around, are there any places in Malaysia where IPs can establish without competing with them? We plot the distribution of community pharmacy premises according to GPS location and separate them by “IP and Small Chain Pharmacy” with “Large and Mega Chain Pharmacy” as below:

From the map above, the red dot represented Chain pharmacies and the blue dot represented IPs and small chain pharmacies (< 10 premises). We can see that most of the city areas are filled with the red dots, whereas some IPs aren’t surrounded by the red dots in some rural areas. Chain pharmacies are still not prominent in northern areas such as Kedah and Perak.

Words from authors:

After the wave of the covid pandemic, we observed that there are drastic changes in the major players in the pharmacy industry. There are new brands that emerged from the merger, the throne is challenged by new players and the situation of ABC-HS in Malaysia. We hope that this competition will lead to a better environment in the future of the pharmacy industry.

AIPharm works hard to ensure that we deliver a high-quality data-driven article for our pharmaceutical industry. If you want to have more in-depth details of the report such as the situation of pharmacies in each state and the full listing of the brand. Please consider supporting us by pre-ordering our full report here

AIPharm (TM) is the first specialised pharmaceutical data-driven platform to provide real-time reliable and finest quality analysis and tracking reports. We cherish every single piece of data and we will work the best out of them.

Email us at thedatawayschannel@gmail.com if you wish to get our team to work on your analytical reporting, on any related topics! TnC applies.

Disclaimer:

- The data used in this article is obtained from Pharmacy.gov.my on 4th June 2022.

- Premis count may not reflect the actual premise with a variance of 5% as there will be closure and wrong address entered

- All statements in the research are purely represented by our interest only

- This article is not funded and sponsored

References:

[1] https://github.com/MoH-Malaysia/covid19-public/blob/main/static/population.csv