The Malaysia Dentistry Report 2022

In this research, we are interested in visualizing the distribution of Malaysia-registered Dentists and Dental clinics in Malaysia. We will explore the dentist industry from 3 perspectives which are:

- Registered Dentist in Malaysia

- Dental Groups in Malaysia

- Private and Government Dental Industry in Malaysia

The data we used is the published data by the Malaysia Dental Council (MDC) in DPIMS dated November 2022. These data include the Date of Registration, Practising Address, Qualification and Category of Service submitted by the registered dentist to MDC.

*As for clarification of the research, the date of registration mentioned in this article is the date the dental houseman registered as a licensed dentist in Malaysia.

Overview of Registered Dentists in Malaysia

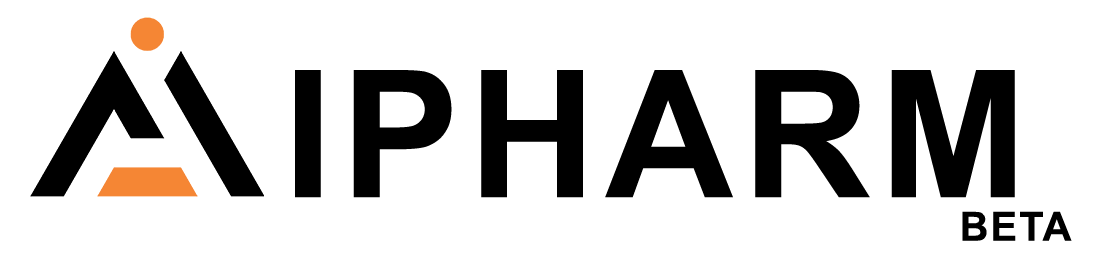

To date, there are 13,252 registered dentists in Malaysia. 7,692 (58%) dentists service in Government Sector and 5,560 (42%) dentists services in Private Sector. Dentists' services in the Government sector are mainly in Hospitals, Universities, Government Dental Clinics and State/National Health departments whereas dentists' services in the Private sector mainly distribute in Private Dental clinics, Private Universities and Private hospitals.

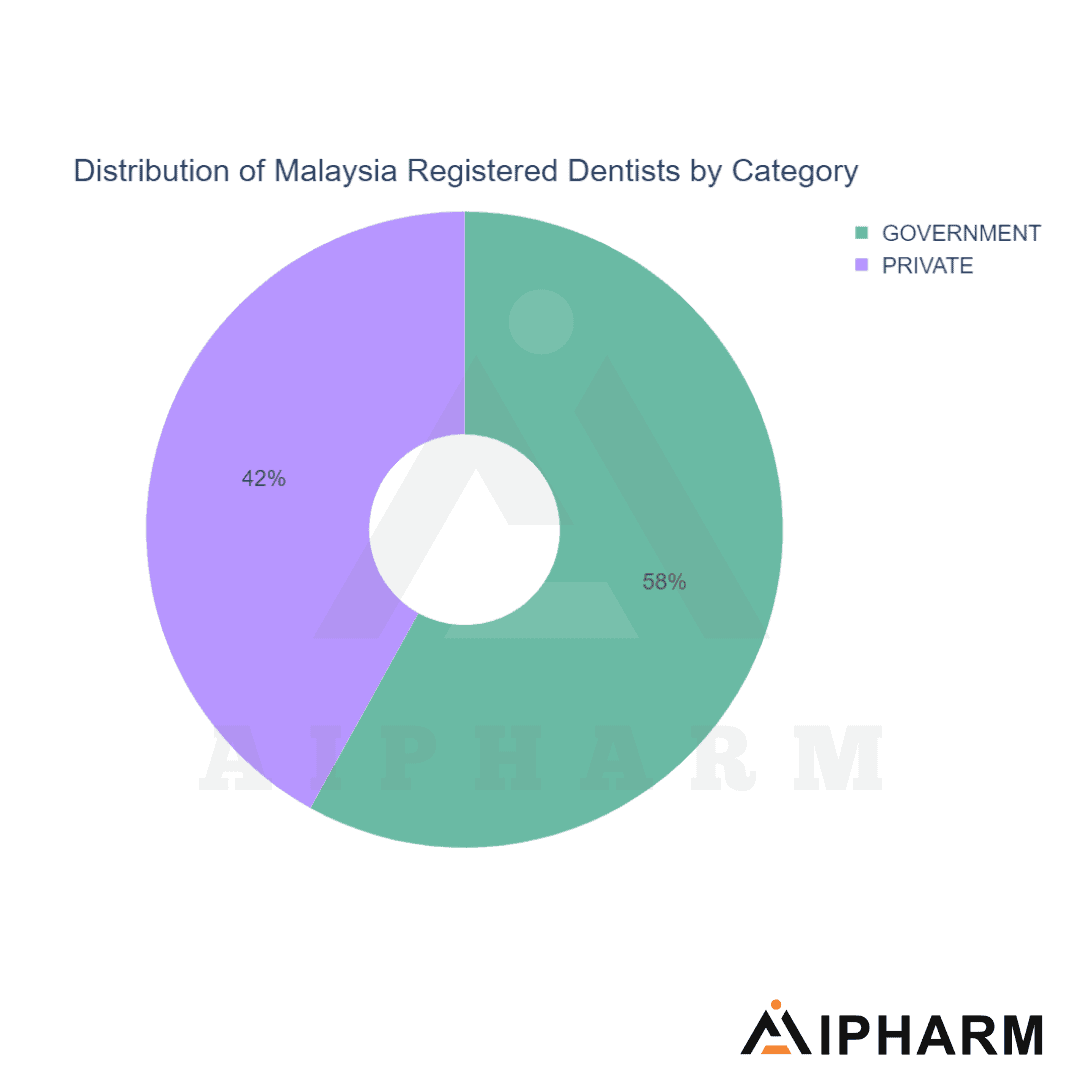

*Due to the time of this research, the number of dentists registered in 2022 might be incomplete yet (Up till November 2022).

Zooming into the registration of dentists in Malaysia. The number of dentists registered in Malaysia had dropped from its peaked in 2017. The average number of dentists produced dropped to below 1,000 per year.

As current, the ratio of dentists to the population of Malaysia is 1: 2464 people in Malaysia (1:2180 in Penisular Malaysia and 1:4917 in Borneo) which is a tremendous drop from what was mentioned in this article. This might be due to the article referring to the GIS research done in 2018.

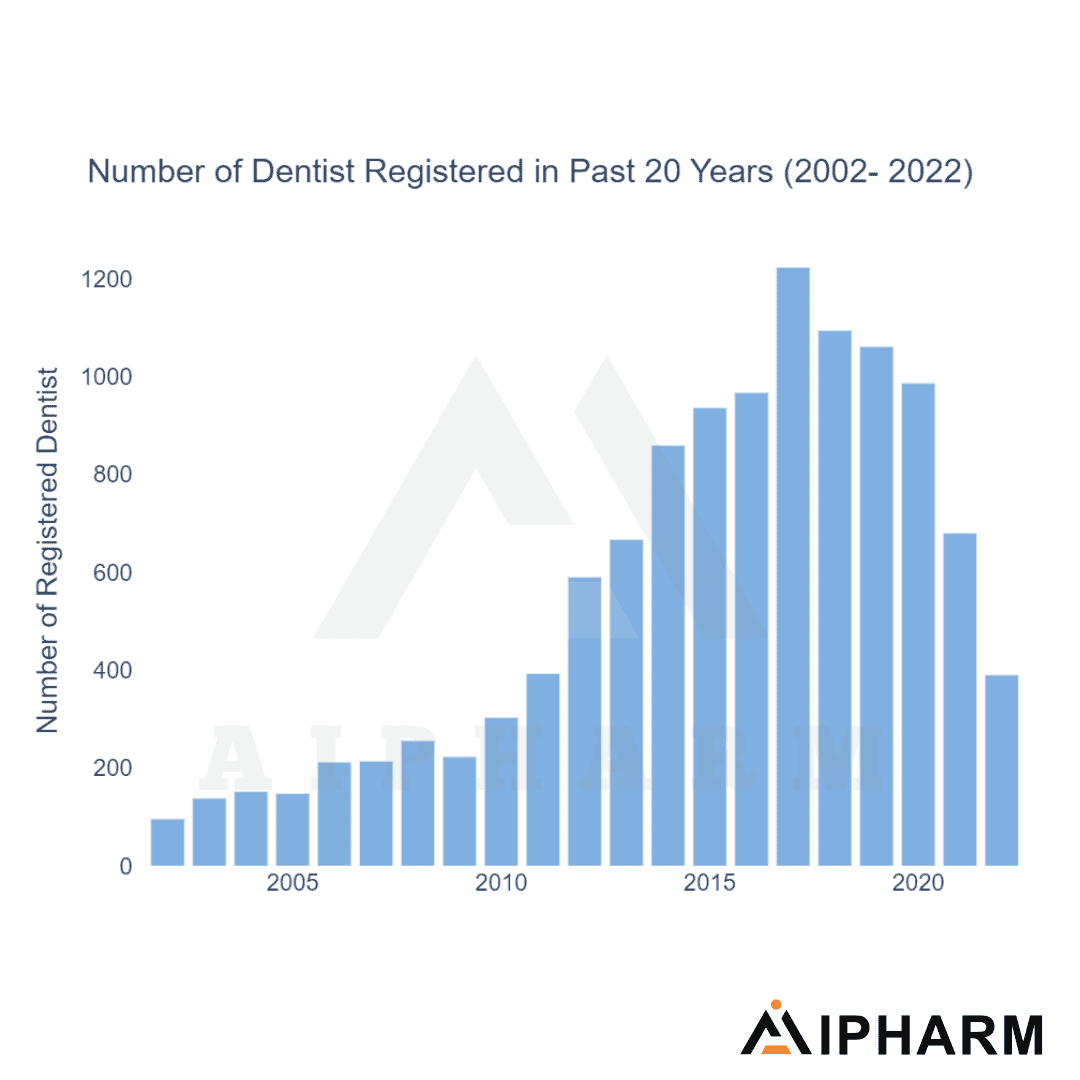

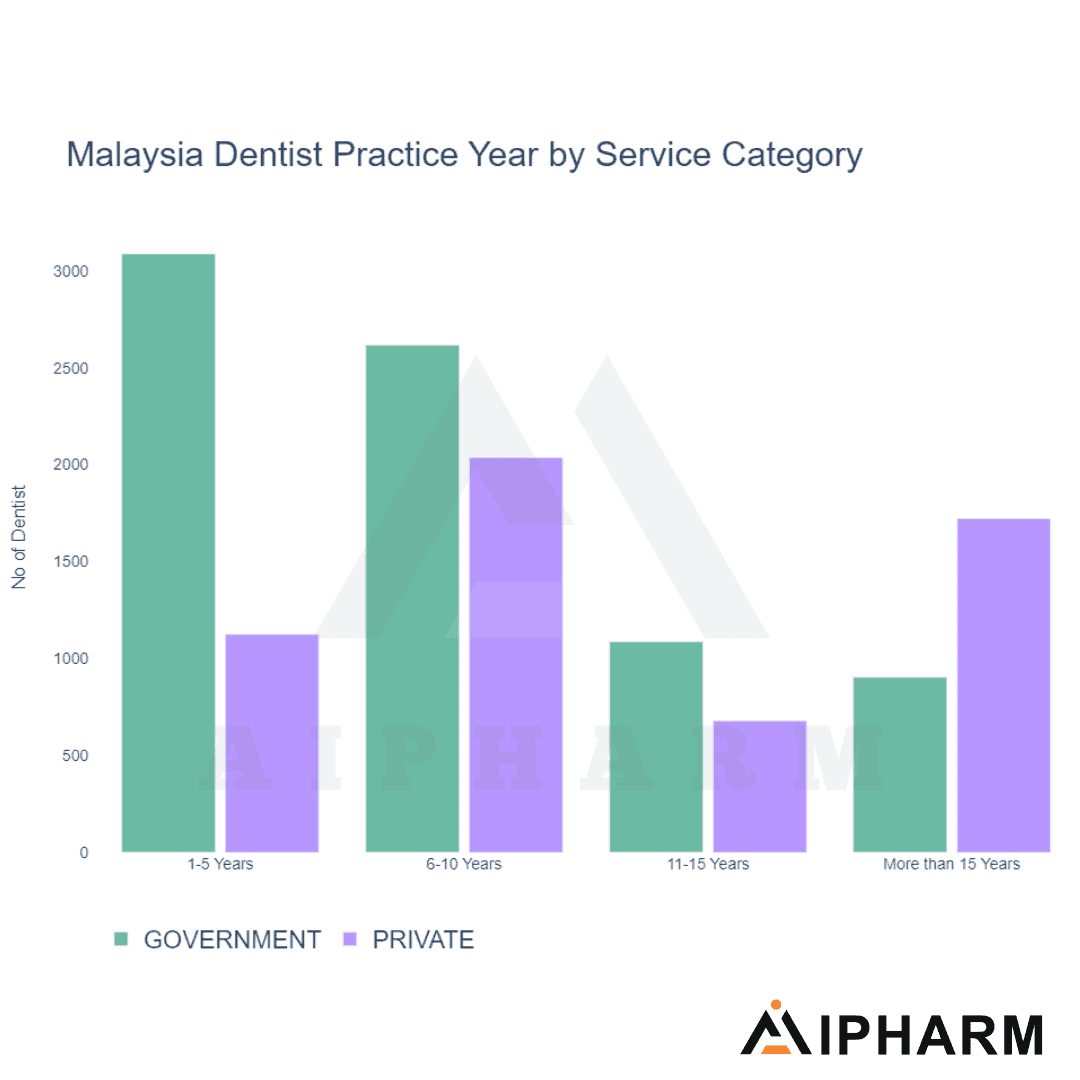

Due to the increase in the registration of Dentists in the past 10 years, we can observe a significant amount of dentists with less than 10 years of experience in Malaysia. For the next 10 years, our nation will be filled with lots of skilled dentists as compared to the younger dentists if the rate of dentist registration is slowed down. (a similar situation we called as Dentist Boom Period).

We further drive by comparing years of practice for dentists in the government sector with the dentist in the private sector, it is found that the dentist with experience of more than 5 years started to flow into the private sector which might be due to the policy implemented during peak dental registration. Another point to take note of is that private dentists with more than 15 years of experience are more than government dentists, it can be due to the dentist continuing their practice in private after their retirement age.

Distribution of Dentists by State

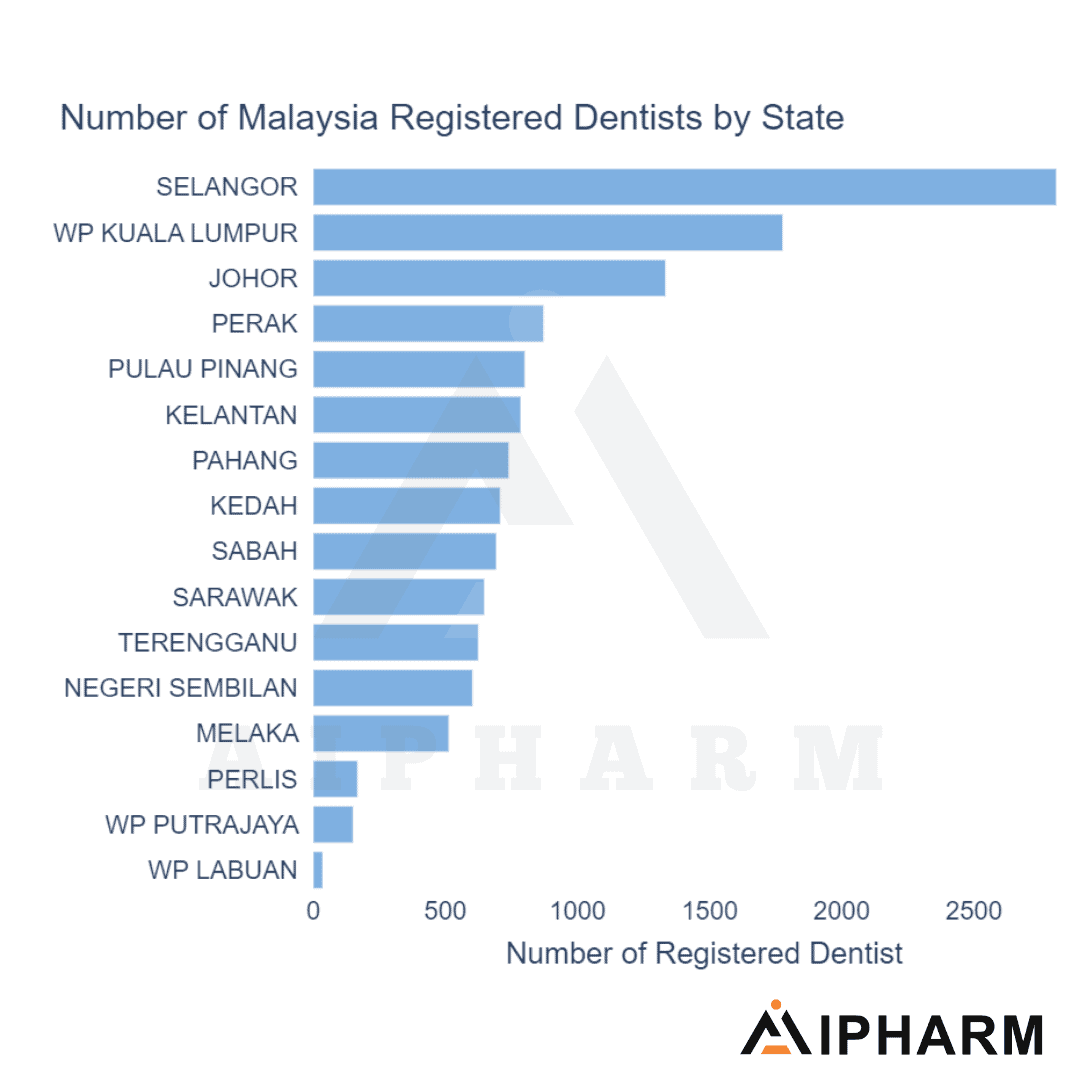

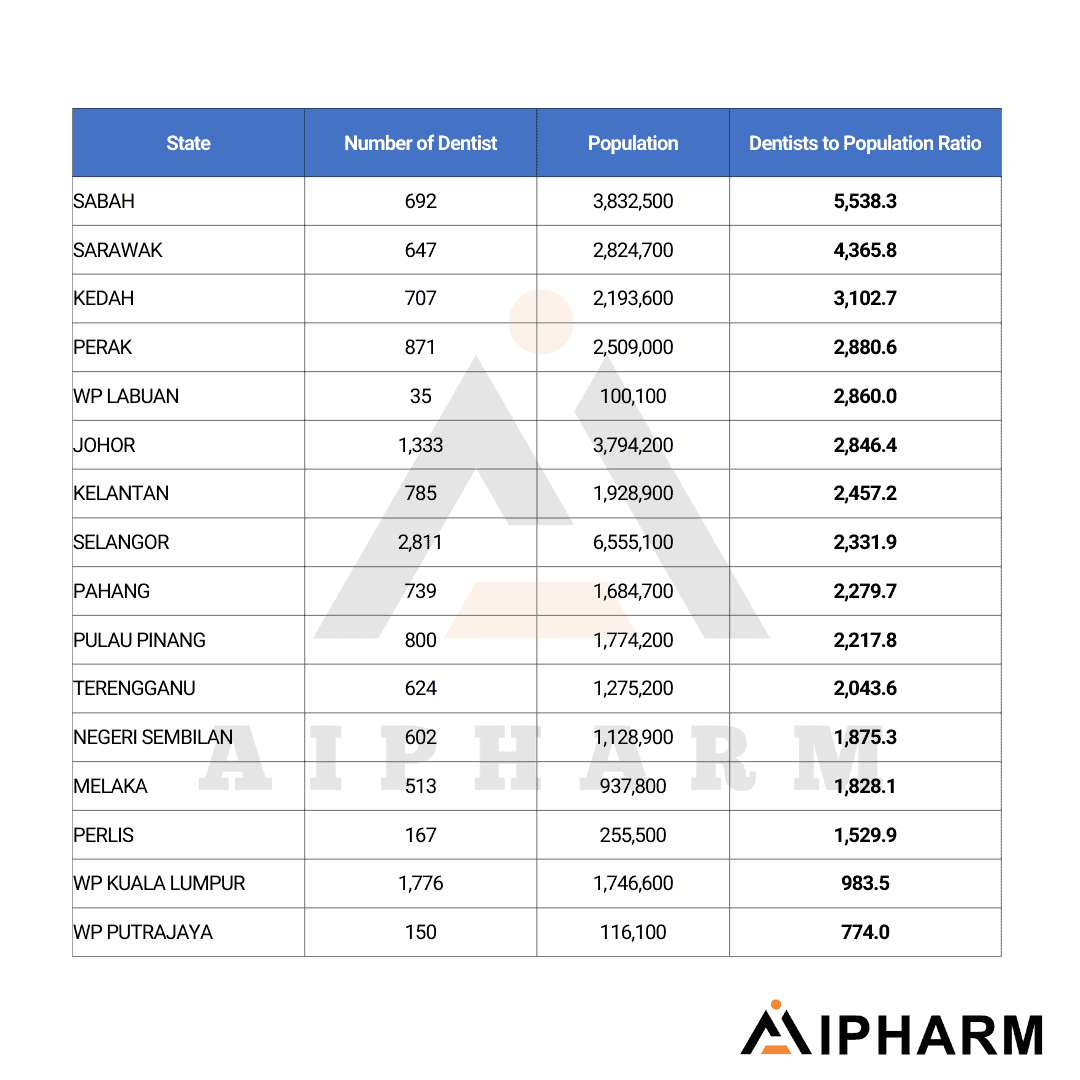

The next question of this research is which state in Malaysia has the most dentist and dental clinics. Klang valley - Selangor (2,811) and WP Kuala Lumpur (1,776) have the most registered dentist followed by Johor (1,333) and Perak (871) which roughly reflect by the dental to-population ratio in the state. One notable shortage is in the number of Dentists in Sabah (692) and Sarawak (674), it is much lower in terms of dentists to population.

Sabah (1:5538) and Sarawak (1:4365) have the highest dentist-to-population ratio as compared to WP Kuala Lumpur (1:983). The highest dentist-to-population ratio in Penisular Malaysia is Kedah (1:3102). Surprisingly the dentist-to-Population ratio in Selangor (1:2331) doesn't as low as expected and the dentist-to-population of Klang Valley is 1:1777.

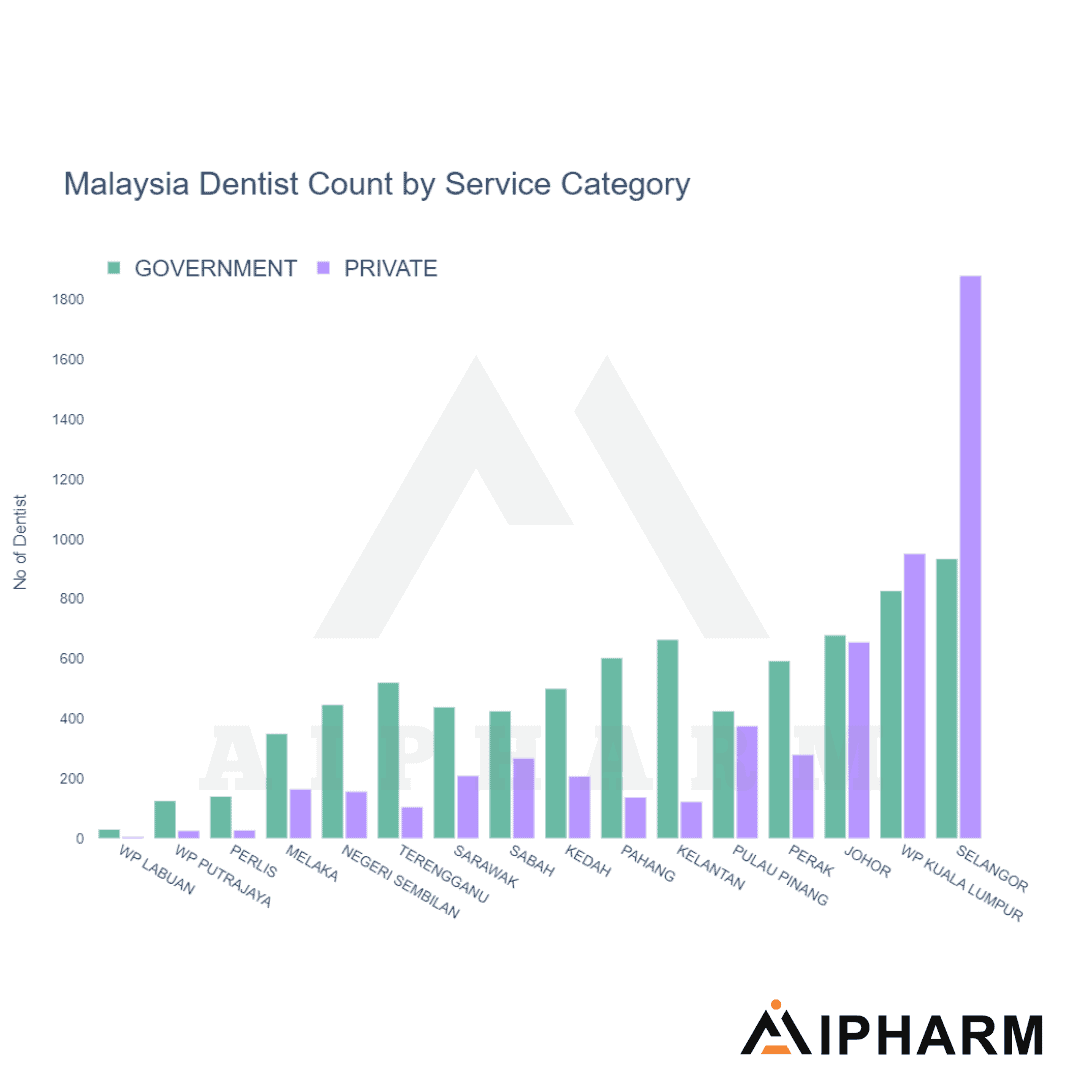

If we categorized dentists in each state by their service category, it is found that only Selangor (1878 vs 933) and WP Kuala Lumpur (950 vs 826) have more private dentists than government dentists whereas Johor (655 vs 678) and Pulau Pinang (375 vs 425) have almost equal amounts of dentists in private and government sectors. The rest of the state have much lesser private dentist than the government sector.

Private Dental Groups Overview

When doing this research, we found out that dentists like to brand themself as dental groups, where multiple dentists form an alliance to become stronger by sharing their resources and expertise. It attracted us to further drive into these dental groups and see which dental group is dominating the industry or the healthiness of the industry.

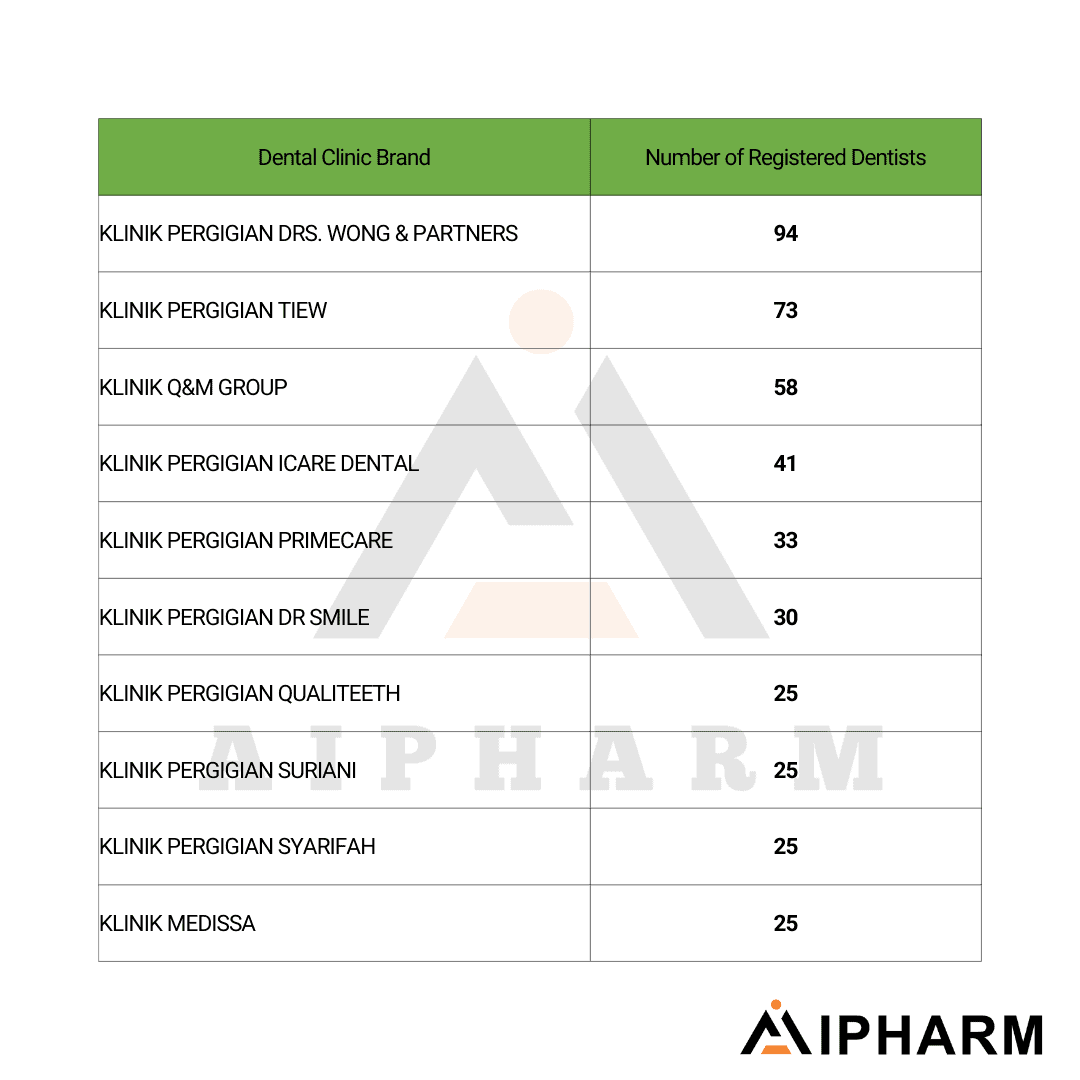

To date, there are approximately 2,200 private dental brands in Malaysia which consist of personal dental clinics, dental groups, and hospitals. If we observe from the number of dentists practising in the dental group, Klinik Pergigian Drs. Wong and Partner (94 dentists) is the largest dental brand in Malaysia (excluding other brands in the SMILE-LINK Healthcare group) followed by Klinik Pergigian Tiew (73 dentists) and Q&M group (58 dentists).

From here we noticed that the dental groups are polarized where there are 3-4 brands having a significantly higher number of dentists in their group while other smaller groups have 10-20 dentists in their groups. The majority of dentists still not forming alliances or forming very small groups with less than 5 dentists.

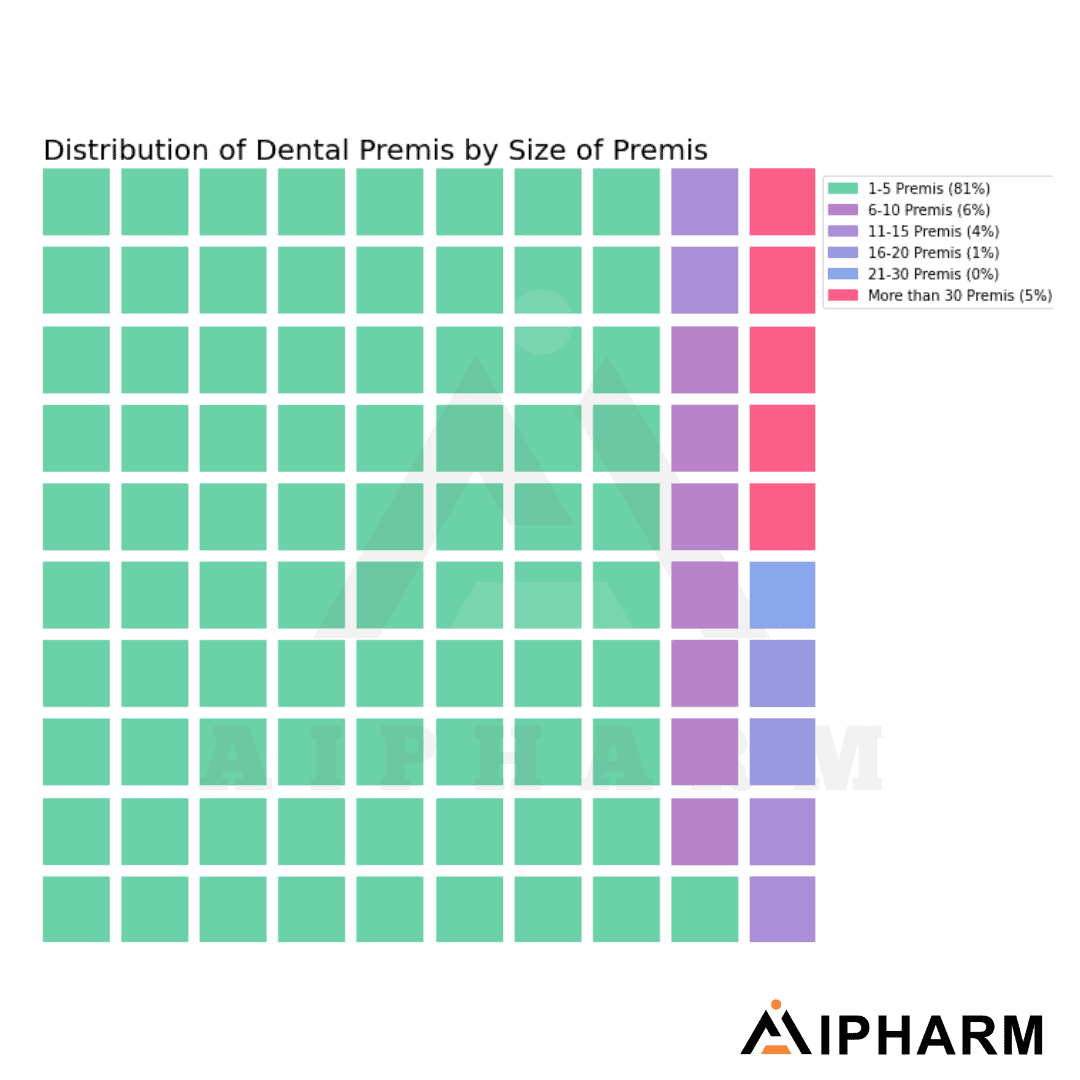

Going to premise analysis, the majority of the Dental brand is still below 5 premises where the dentist alone is working on his own or with few friends, there are only 5 dental groups with more than 30 premises which forms a polarizing effect in the dental industry. Overall, there are still a lot of independent dental clinics in Malaysia and the domination of chain dental groups still doesn't affect much on individual dental clinics.

Words from authors:

From the research, we see there is a major outflow of dentists to the private industry in recent years due to the increased supply of dentists in the industry since the finding in the year 2013. We observe good control of dental registration since 2020 which contributes to the healthy growth of the industry.

To date, each state have unequal distribution of dental workforce and private dental clinic, this might due to the varied awareness of dental health across the nation. Without proper demand, the unequality distribution of private dental clinics will continue to focus on city areas. Unlike the pharmacy industry, the dental industry is more service-orientated, patient will go to the dentist because of the dentist's personality or dentist's skill, most dental clinics can survive as long as they are focusing on improving their service and clients. Therefore, forming an alliance with other dental groups is still optional in the current situation. The private dental industry is still in a less competitive stage and will continue to bloom with higher dental health awareness in our nation.

We hope that this finding can help you understand the Malaysia dental industry better and thank you for reading.

AIPharm works hard to ensure that we deliver a high-quality data-driven article for our pharmaceutical industry. If you want to have the raw data of the report. Please consider supporting us by ordering it here.

AIPharm (TM) is the first specialised pharmaceutical data-driven platform to provide real-time reliable and finest quality analysis and tracking reports. We cherish every single piece of data and we will work the best out of them.

Email us at thedatawayschannel@gmail.com if you wish to get our team to work on your analytical reporting, on any related topics! TnC applies.

Disclaimer:

- The data used in this article is obtained from MDC on November 2022.

- Premis count may not reflect the actual premise with a variance of 10% as there will be closure and different address entered by the person

- All statements in the research are purely represented by our interest only

- This article is not funded and sponsored

References:

[3] Do we have enough dentist?